Thomas P. DiNapoli,

State Comptroller

State Comptroller

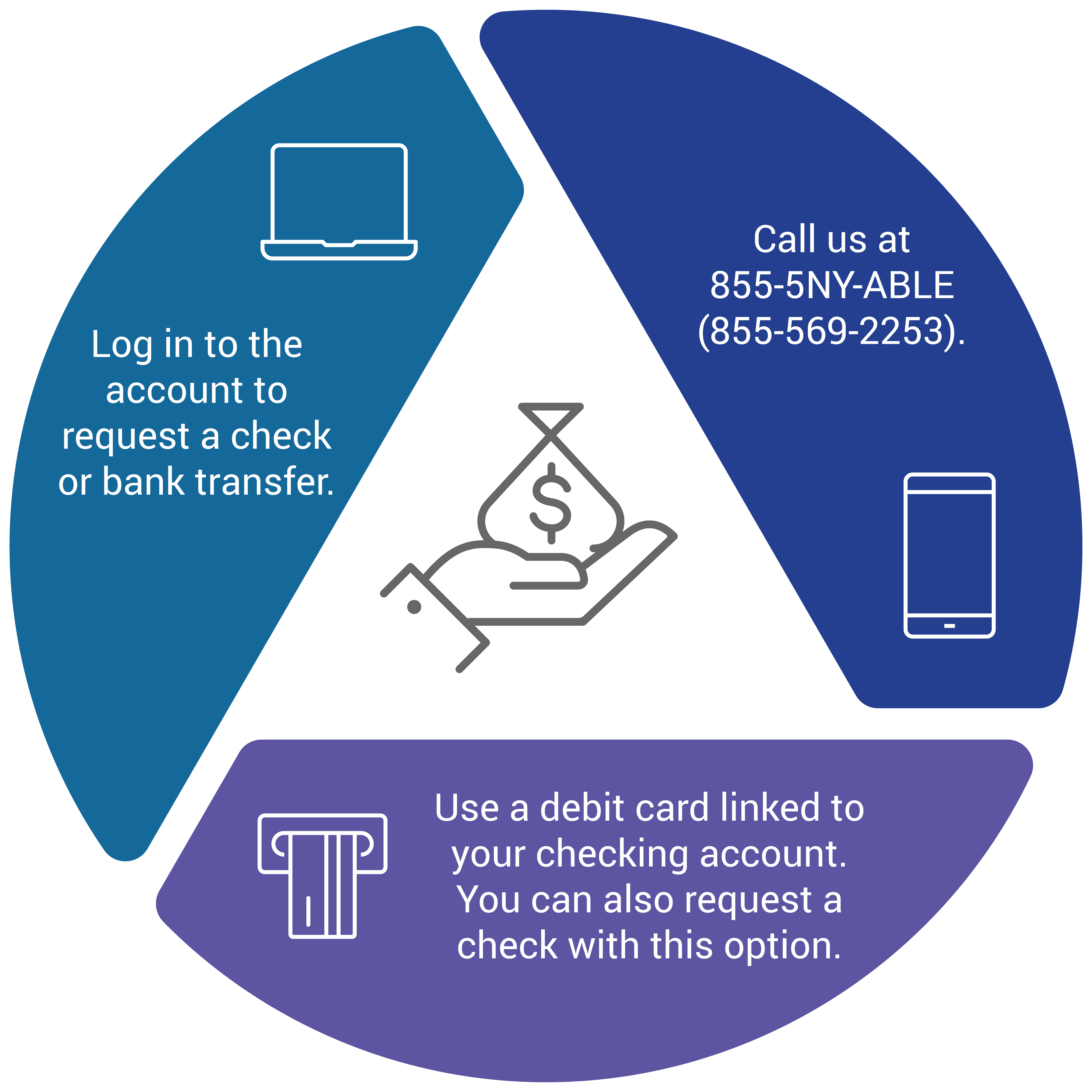

Need to make a withdrawal?

Log in, call in, or use your card.

The account owner, a parent or legal guardian, or an Authorized Individual can withdraw NY ABLE funds one of three ways:

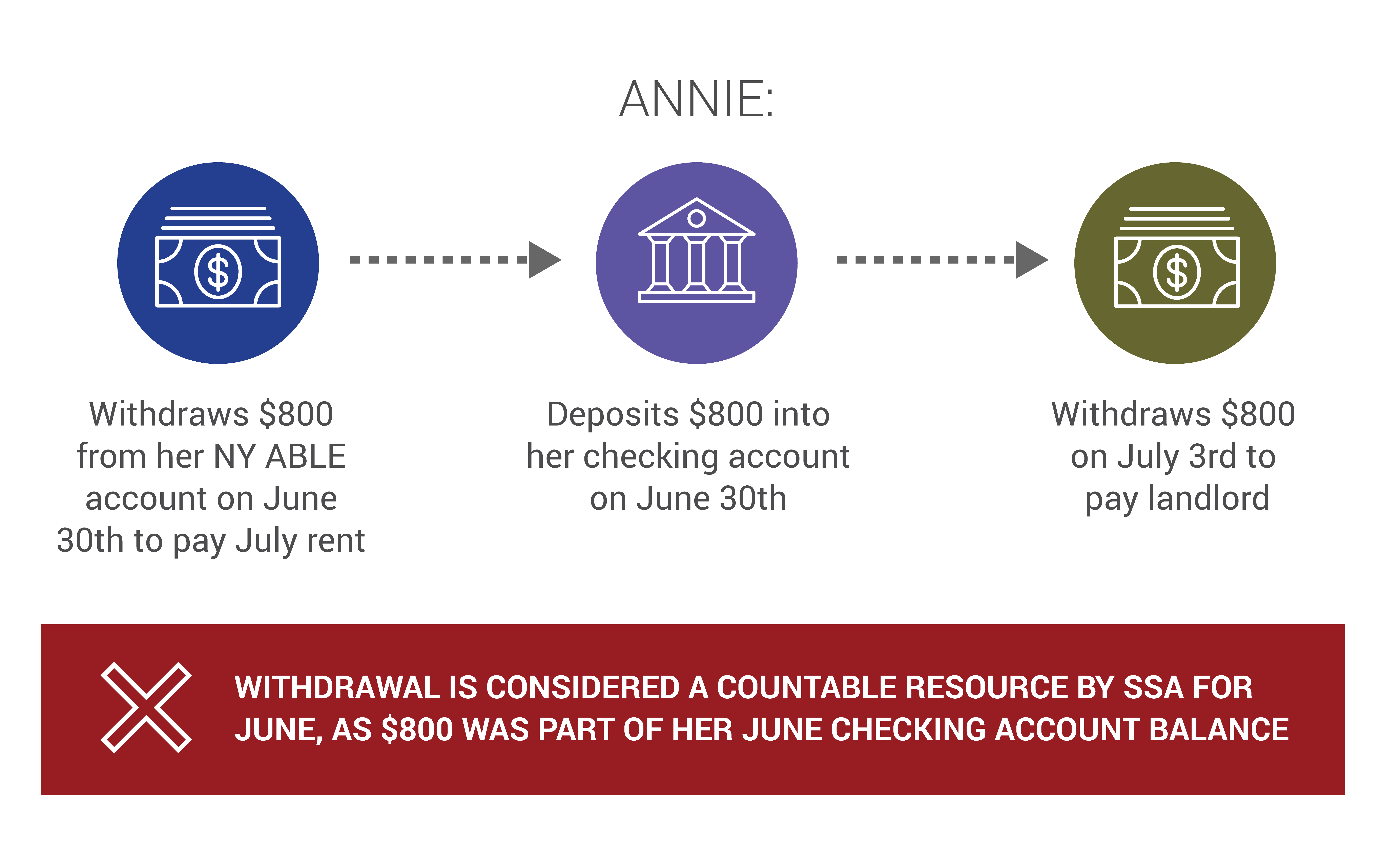

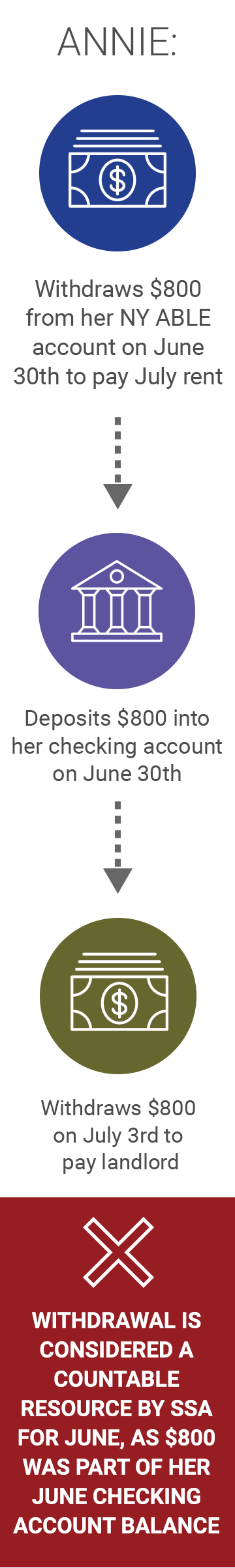

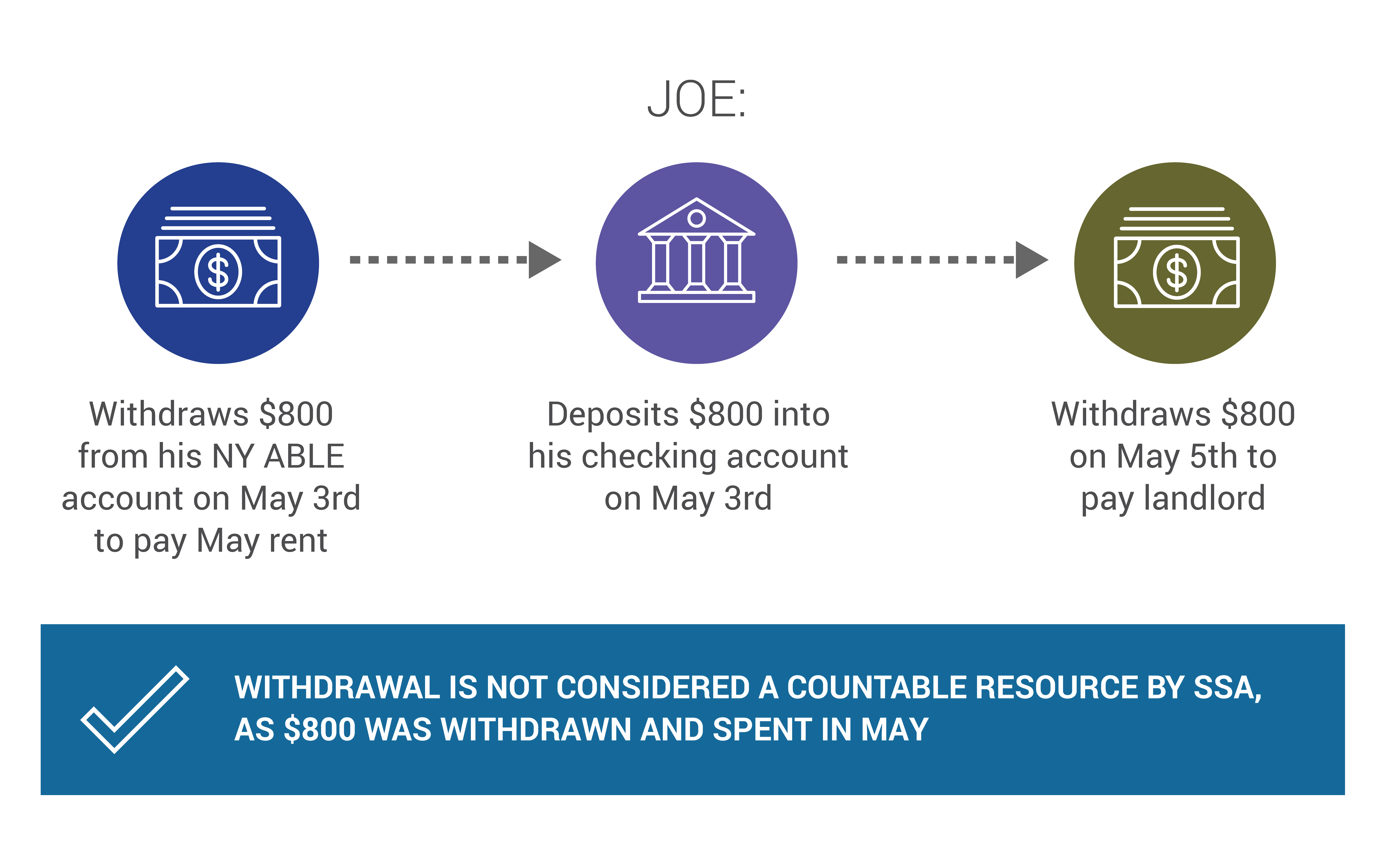

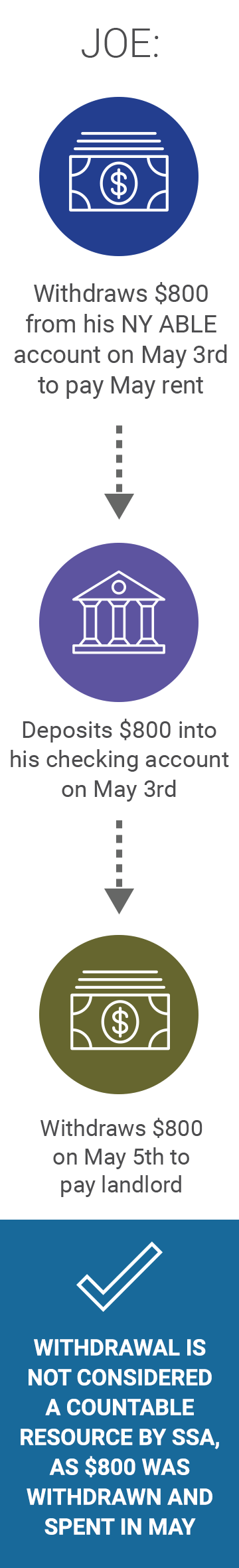

NY ABLE will report the total amount of withdrawals from each account to the IRS, as well as the date and amount of each withdrawal to the Social Security Administration. NY ABLE does not require proof that withdrawals are for qualified expenses, but account owners should keep detailed records.

Automatic Withdrawals

You can establish automatic withdrawals, such as when the account will be used to make payments each month. Automatic withdrawals can be made to the bank listed on the account, by mail to the account owner’s address, or to a third party.

Finally, make your contribution of as little as $25.

Using payroll deduction? Get started with as little as $15.