State Comptroller

What type of investor are you?

The first step in determining what type of investor you are is to understand what “risk” is and to gauge your risk tolerance. Understanding your risk tolerance will guide your approach to investing.

What is risk?

Risk is the measure of volatility (ups and downs) in an investment’s performance. When you invest your money, your investment may have gains or losses due to the rise and fall of the financial markets. The riskier an investment, the greater the likelihood that there will be fluctuations in value based on market changes, both positive and negative, given the uncertainty of the investment’s future value.

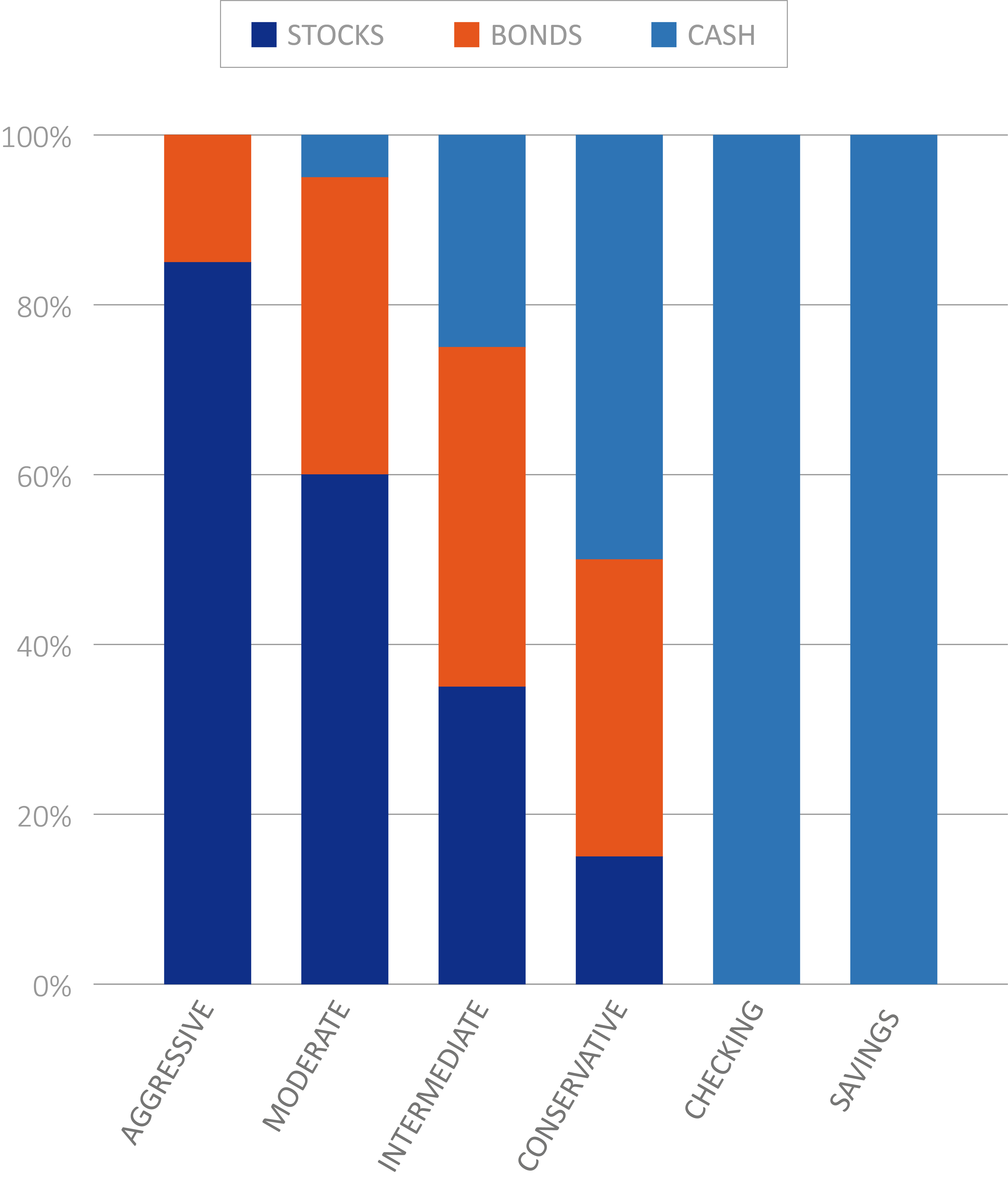

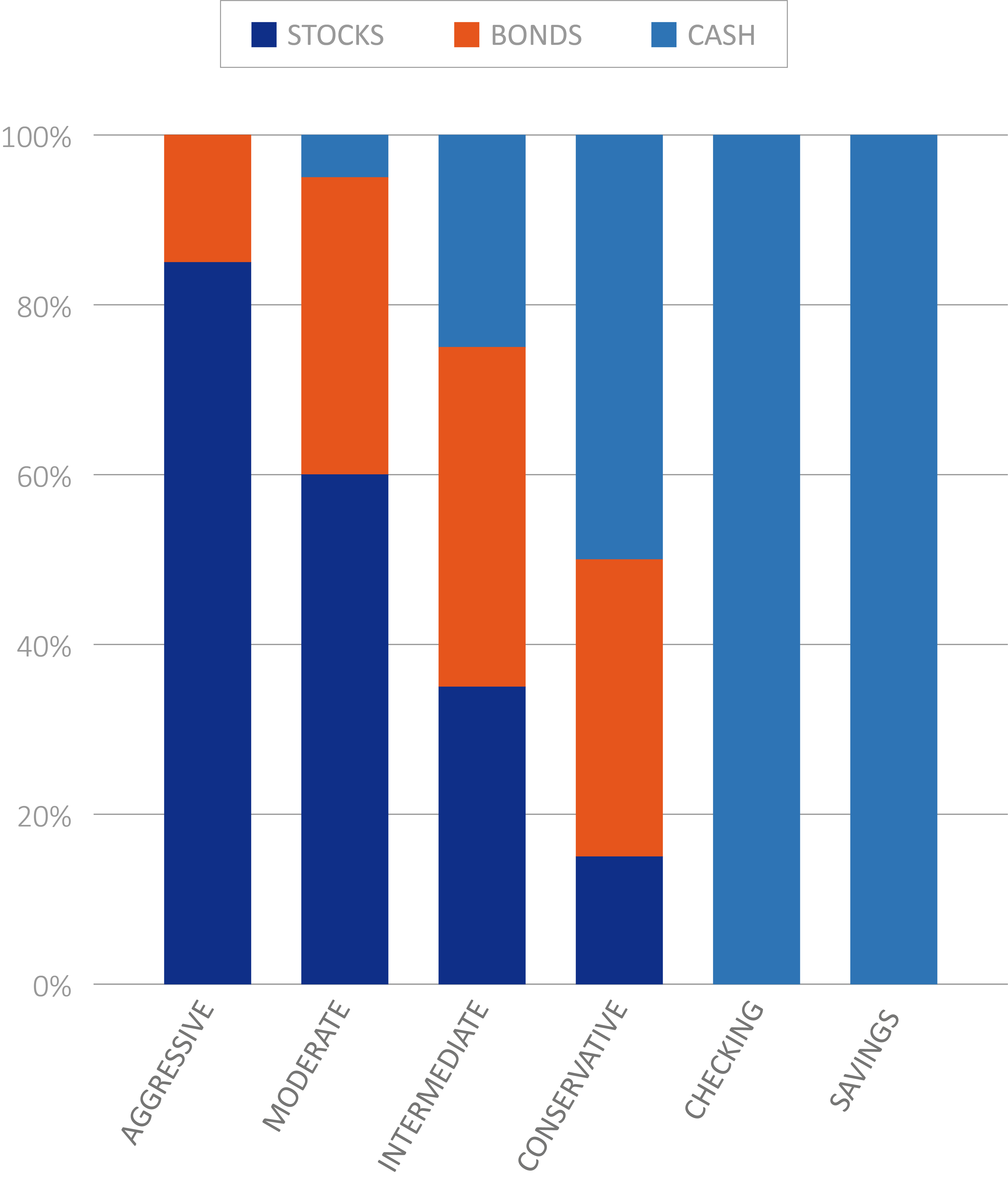

The four risk-based portfolios attempt to manage the risk level, to varying degrees, from aggressive to conservative. The Savings and Checking Options do not have exposure to the financial markets and are not exposed to market fluctuations. Return will vary based on prevailing interest rates. The Savings and Checking Options also carry FDIC insurance. Please refer to the Disclosure Booklet for additional information along with the objectives and risks for each investment option.

What is my risk tolerance?

Risk tolerance is unique to every individual and is defined by how comfortable you are with dealing with the ups and downs of the financial markets. There are a number of questions to ask yourself when deciding your personal risk tolerance.

How soon do I need to use the money invested?

If you need to access funds in the near future, you may want to consider a conservative investment. If the investment goal or expense is years or decades in the future, you may be open to investing in a moderate or aggressive risk product, which historically, over a longer time period, experienced higher returns than more conservative options (but will likely experience higher volatility).

What expenses am I saving for?

- Will the funds be used for day-to-day living expenses or regular disability-related expenses?Am I investing funds in case of an emergency such as an unforeseen medical expense?

- Am I saving for retirement or expenses a long way down the road?

- ABLE accounts can be used to save for short, medium and long-term expenses.

Finally, your investments should not be the cause of additional stress. If you worry about the fluctuation of the financial markets on a day-to-day basis, consider lowering your risk tolerance in your investment portfolio. Your investment should be something you feel proud about.

What kind of investor are you?

If the ups and downs that come from investing in the stock market will keep you awake at night, no matter how long your investment time horizon, then your risk tolerance is probably more conservative. Bonds and short-term investments may be better for you than stocks because they're typically less volatile, but typically offer lower return potential over the long-term. Investing in the Savings, Checking or Conservative Option may be appropriate for you.

If some (but not too drastic) market fluctuations are tolerable, then your risk tolerance is probably more moderate. A mix of stocks and bonds could be appropriate if you plan on being invested for at least five years. An Intermediate or Moderate Option may be the investment choice for you.

If you're comfortable with the ups and downs that come from investing in the stock market, then your risk tolerance is probably more aggressive. The potential for higher returns outweighs the risk of losing money. A portfolio that holds more stocks than bonds, such as the Aggressive Option, may be the right choice.

Snapshot: NY ABLE Investment Portfolios

The four risk-based portfolios attempt to manage the risk level, to varying degrees, from aggressive to conservative. The Savings and Checking Options do not have exposure to the financial markets and are not exposed to market fluctuations. Return will vary based on prevailing interest rates. The Savings and Checking Options also carry FDIC insurance.

Please refer to the Disclosure Booklet for additional information along with the objectives and risks for each investment option.