State Comptroller

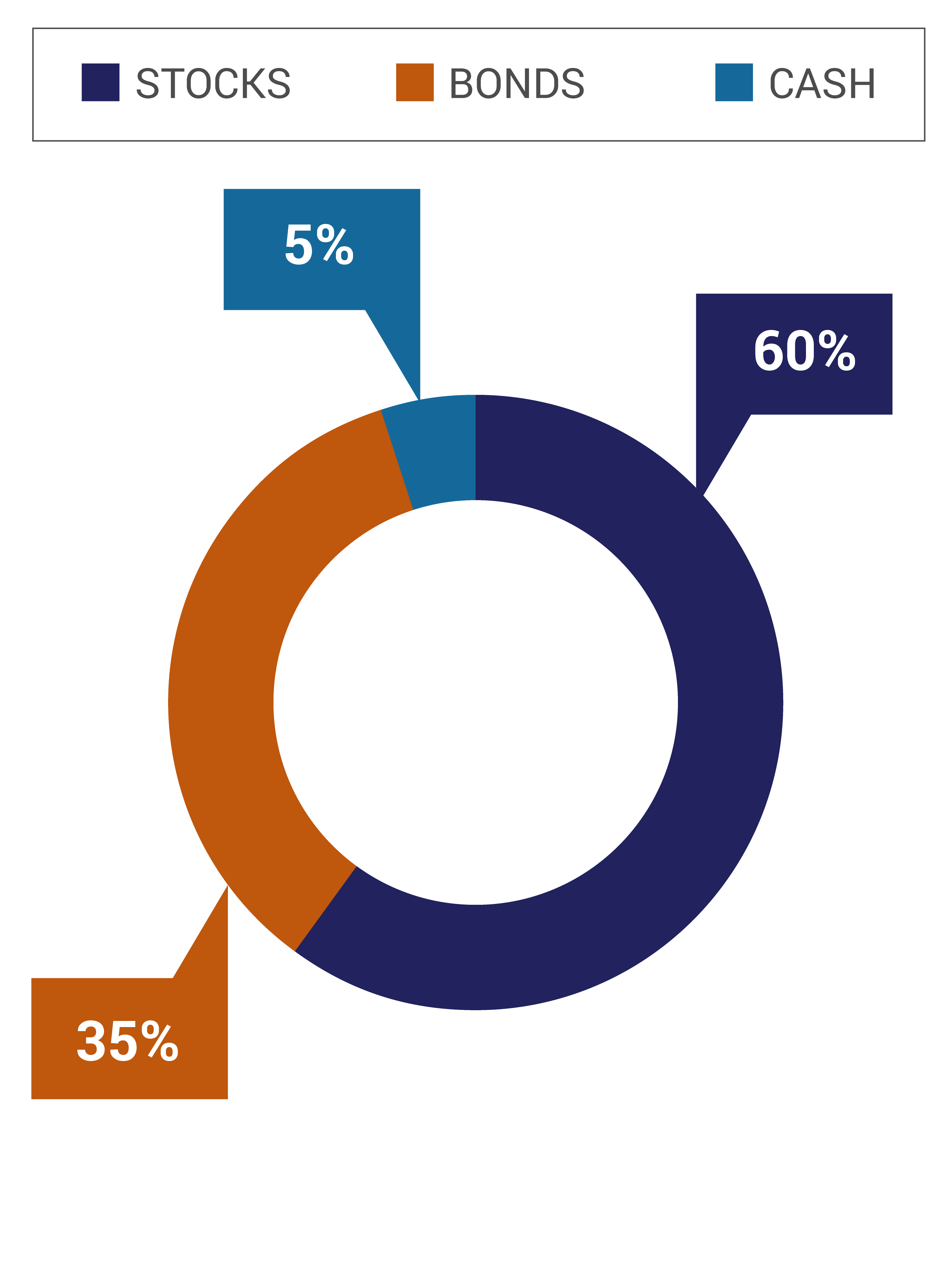

Objective

The Aggressive Investment Option seeks long-term growth.

Strategy

This Investment Option is subject to greater market risk and volatility than the other Investment Options. This Investment Option has a strategic allocation of approximately 56% U.S. equity securities, 29% international equity securities, 9.5% U.S. fixed income securities, and 5.5% international fixed income securities. This Portfolio may be more suitable for investors with a higher risk tolerance. The approximate percentages of the Investment Option’s assets allocated to each Underlying Fund are:

Risks

The Aggressive Investment Option has a number of investment related risks. For a list and descriptions of the risks associated with the Vanguard funds, see the Explanation of Investment Risk Factors section in the NY ABLE Savings Program Disclosure Booklet and Participation Agreement.

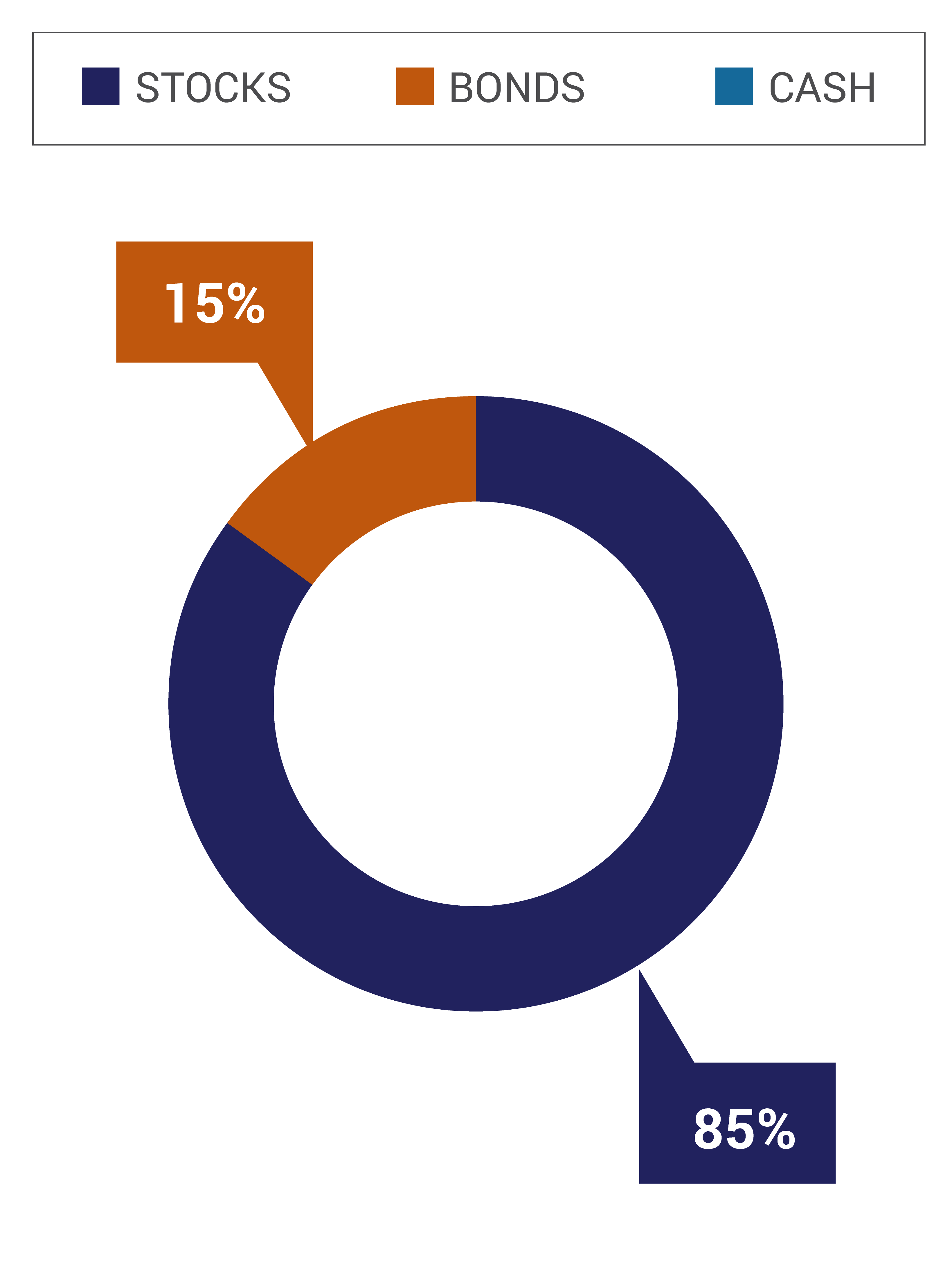

Objective

The Moderate Investment Option seeks capital appreciation and income.

Strategy

Although this Investment Option is expected to be subject to less market risk and volatility than the Aggressive Option that invest a higher percentage of their assets in equity securities, its potential return is also expected to be lower. This Investment Option has a strategic allocation of approximately 39.50% U.S. equity securities, 20.50% international equity securities, 22.5% U.S. fixed income securities, and 12.5% international fixed income securities. The approximate percentages of the Investment Option’s assets allocated to each Underlying Fund are:

Risks

The Moderate Investment Option has a number of investment related risks. For a list and descriptions of the risks associated with the Vanguard funds, see the Explanation of Investment Risk Factors section in the NY ABLE Savings Program Disclosure Booklet and Participation Agreement.

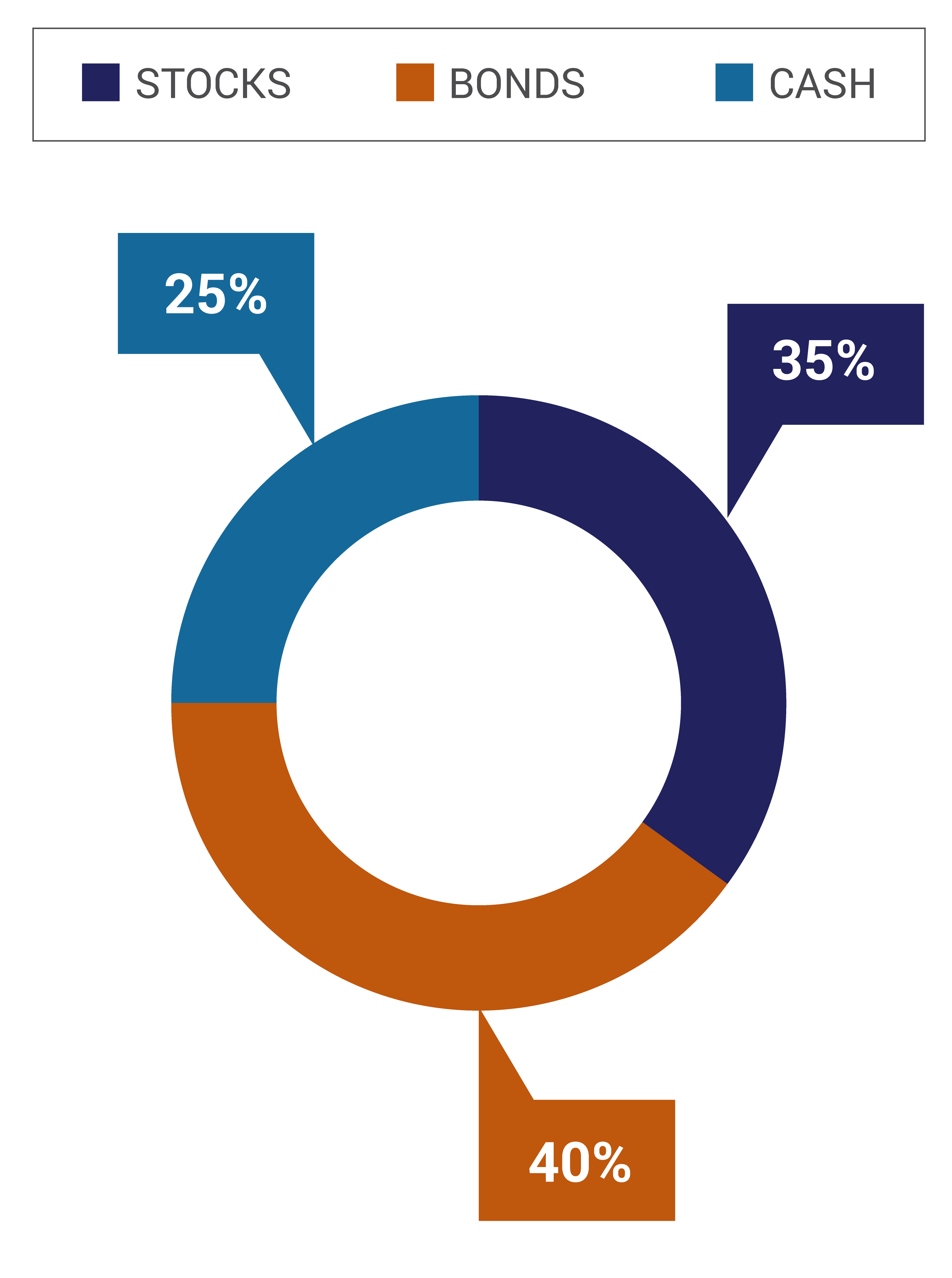

Objective

The Intermediate Investment Option seeks capital appreciation and income.

Strategy

This Investment Option seeks conservative growth by investing in an asset allocation weighted toward fixed income investments over equity investments. This Investment Option is expected to be subject to less market risk and volatility than the Aggressive and Moderate Investment Options, but is expected to offer lower potential returns. This Investment Option has a strategic allocation of approximately 23% U.S. equity securities, 12% international equity securities, 26% U.S. fixed income securities, 14% international fixed income securities, and 25% cash equivalents. The approximate percentages of the Investment Option’s assets allocated to each Underlying Fund are:

Risks

The Intermediate Investment Option has a number of investment related risks. For a list and descriptions of the risks associated with the Vanguard funds, see the Explanation of Investment Risk Factors section in the NY ABLE Savings Program Disclosure Booklet and Participation Agreement.

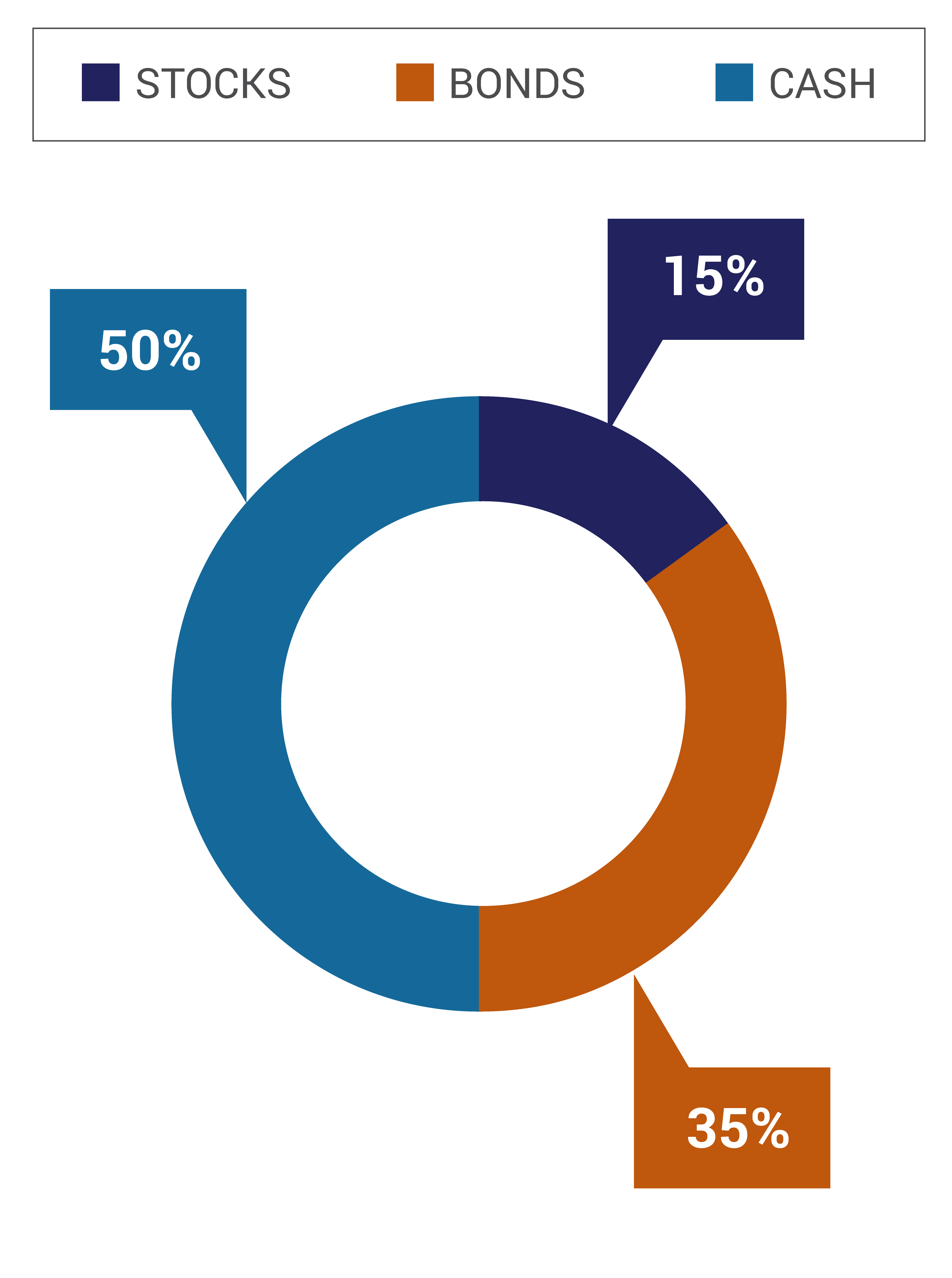

Objective

The Conservative Investment Option seeks income and protection of principal.

Strategy

This Investment Option is expected to be subject to less market risk and volatility than each of the other Investment Options, but is expected to offer lower potential returns. This Investment Option has a strategic allocation of approximately 10% U.S. equity securities, 5% international equity securities, 22.5% U.S. fixed income securities, 12.5% international fixed income securities, and 50% cash equivalents. The approximate percentages of the Investment Option’s assets allocated to each Underlying Fund are:

Risks

The Conservative Investment Option has a number of investment related risks. For a list and descriptions of the risks associated with the Vanguard funds, see the Explanation of Investment Risk Factors section in the NY ABLE Savings Program Disclosure Booklet and Participation Agreement.

Objective

The Checking Option seeks to provide preservation of principal.

Strategy

The Checking Option invests all of its assets in a checking account held at Fifth Third Bank.

Investments in the Checking Option will earn varying rates of interest. Contributions will not earn interest until the hold period expires and the funds are deposited to the account at Fifth Third Bank. The interest rate generally will be equivalent to short-term deposit rates. Interest will be compounded daily based on the actual number of days in a year and will be credited to the Checking Option on a monthly basis. The interest on the Checking Option is expressed as an Annual Percentage Yield, or APY. The APY on the Checking Option will be reviewed by Fifth Third Bank on a periodic basis and may be recalculated as needed at any time. To see the current Checking Option Annual Percentage Yield, please go to www.53.com or call toll-free 888-516-2375.

Risks

The Checking Option is primarily subject to the risk that the return on the underlying checking account will vary because of changing interest rates and that the return on the checking account may decline because of falling interest rates. See, Appendix A – Fifth Third Terms and Conditions in the NY ABLE Savings Program Disclosure Booklet and Participation Agreement for additional terms and conditions applicable to the Checking Option.

FDIC Insurance

Subject to the application of Fifth Third Bank (for the Checking Option) and FDIC rules and regulations to each Account Owner, funds in the Checking Option will retain their value as a result of FDIC insurance. Please visit www.fdic.gov for more information about FDIC insurance coverage.

No other guarantees

FDIC insurance is the sole insurance available for the Checking Option. The Checking Option does not provide a guarantee of any level of performance or return or offer any additional guarantees. Neither the contributions into the Checking Option, nor any investment return earned on the contributions is guaranteed by the Plan Administrators, or any other federal or state entity or person.

The Checking Option is primarily subject to the risk that the return on the underlying checking account will vary because of changing interest rates and that the return on the checking account may decline because of falling interest rates. See, Appendix A – Fifth Third Terms and Conditions in the NY ABLE Savings Program Disclosure Booklet and Participation Agreement for additional terms and conditions applicable to the Checking Option.

Objective

The Savings Option seeks to provide preservation of principal. STRATEGY: The Savings Option seeks income consistent with the preservation of principal and invests all of its assets in a savings account (the Savings Account) held at Sallie Mae Bank. The Savings Account is an omnibus savings account insured by the FDIC and is held in trust by NY ABLE at Sallie Mae Bank. Investments in the Savings Option will earn varying rates of interest. The interest rate generally will be equivalent to short-term deposit rates. Interest on the Savings Account will be compounded daily based on the actual number of days in a year (typically 365 days, except for 366 days in leap years) and will be credited to the Savings Account on a monthly basis. The interest on the Savings Account is expressed as an annual percentage yield ("APY"). The APY on the Savings Account will be reviewed by Sallie Mae Bank on a periodic basis and may be recalculated as needed at any time. To see the current Savings Option APY please go to www.mynyable.org.

Risks

The Savings Option is primarily subject to the risk that the return on the underlying savings account will vary because of changing interest rates and that the return on the savings account may decline because of falling interest rates.

FDIC Insurance

Subject to the application of Sallie Mae Bank (for the Savings Option) and FDIC rules and regulations to each Account Owner, funds in the Savings Option will retain their value as a result of FDIC insurance. The Program Administrator is not responsible for determining the amount of FDIC insurance provided to an Account Owner. Please visit www.fdic.gov for more information about FDIC insurance coverage.

No other guarantees

FDIC insurance is the sole insurance available for the Savings Option. The Savings Option does not provide a guarantee of any level of performance or return or offer any additional guarantees. Neither the contributions into the Savings Option, nor any investment return earned on the contributions is guaranteed by any NY ABLE Official or any other federal or state entity or person.